Navigating the Trade Winds: How US Tariffs are Reshaping the Luxury Automotive Landscape in 2025

The roar of a finely tuned engine, the gleam of hand-polished paintwork, the unmistakable scent of Connolly leather – these are the hallmarks of ultra-luxury motoring. Yet, even the most exquisite vehicles from esteemed brands like Aston Martin are not immune to the mundane realities of international trade. As of early 2025, the shadow of import tariffs continues to stretch across the Atlantic, compelling iconic manufacturers to rethink their strategies for the critical US market. Aston Martin, a titan of British craftsmanship, has recently announced it is carefully limiting imports to the United States, a strategic pivot necessitated by persistent tariff pressures. This decision is more than just a logistical adjustment; it’s a window into the profound economic impact of trade policies on the high-end automotive sector, forcing a reevaluation of everything from pricing to global supply chain resilience.

For a decade, I’ve had a front-row seat to the intricate dance between automotive innovation, market demand, and geopolitical shifts. What we’re witnessing now is a critical juncture where established norms are being challenged, and the future trajectory of luxury car market trends is being recalibrated by policy decisions.

Aston Martin’s Strategic Pause: A Symptom of Broader Uncertainty

In a recent earnings report, Aston Martin’s CEO, Adrian Hallmark, articulated a sentiment echoed across the industry: the tariffs have injected a “high degree of uncertainty” into planning and operations. This isn’t merely about higher costs; it’s about unpredictability, which stifles investment, complicates forecasting, and strains supply chains. The immediate response from Gaydon has been to “limit imports to the US while leveraging the stock held by our US dealers.” This calculated move aims to manage inventory levels, preventing an oversupply that would incur significant holding costs under the new tariff regime, while simultaneously avoiding a complete market withdrawal that could damage brand presence.

Executives on a call with analysts clarified that this strategy provides a buffer, with current US dealer stock anticipated to last through early June 2025. Beyond that, the company is actively exploring a range of options to mitigate the impact of the reported 25% tariff on imported vehicles. Hallmark spoke of “pricing scenarios on standby” and a “mixed approach” – neither fully absorbing the tariff burden nor entirely passing it on to the discerning clientele. This delicate balance underscores a critical challenge for premium automotive brands strategy: how to preserve an exclusive brand image and perceived value while navigating external cost pressures. Absorbing too much erodes profitability, crucial for R&D into the future of electric supercars and next-generation models; passing on too much risks alienating a clientele that, while affluent, is acutely aware of value and brand prestige.

The Economic Undercurrents: Dissecting the Tariff Mechanism

To truly grasp the predicament facing Aston Martin and its peers, one must understand the mechanics and intent behind these tariffs. Imposed by various administrations over recent years, these duties are typically levied on imported goods with the stated aim of protecting domestic industries, stimulating local production, or addressing perceived trade imbalances. In the automotive sector, this usually translates to a percentage increase on the declared value of the imported vehicle or component. For a luxury supercar with a sticker price often exceeding a quarter-million dollars, a 25% tariff adds tens of thousands to the final cost before even considering dealer markups or bespoke options.

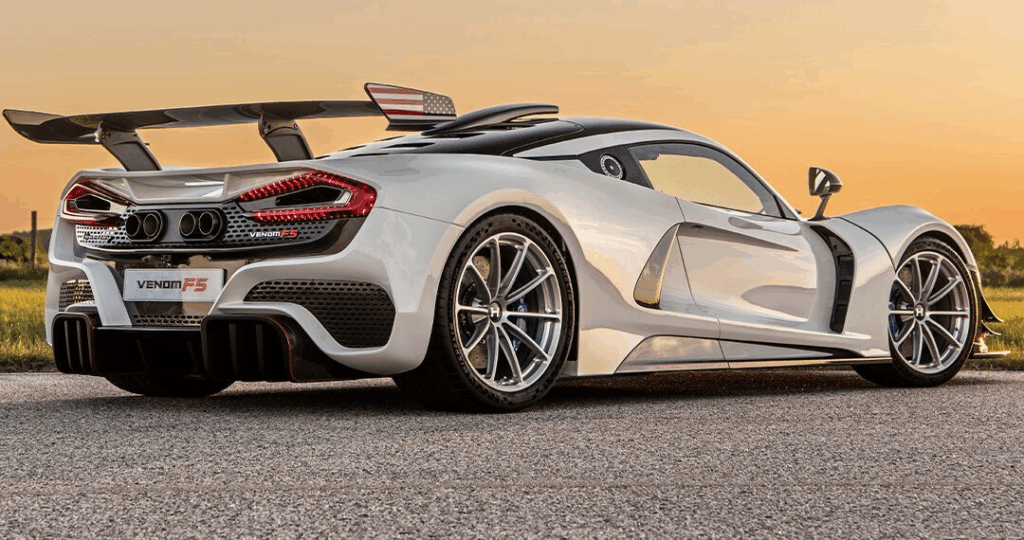

While the original intent of such tariffs might focus on bolstering general manufacturing, their application to ultra-luxury vehicles like the Aston Martin Vantage or Vanquish presents a unique conundrum. These are not mass-market cars competing directly with domestic production in terms of volume. Their appeal lies in their bespoke craftsmanship, heritage, and performance – attributes often exclusive to their country of origin. Consequently, the economic impact of trade policies here isn’t necessarily fostering new domestic luxury car production, but rather increasing the cost of exclusivity and potentially reducing choice for high-net-worth individuals. This nuanced effect highlights the complexities of broad-stroke trade measures on highly specialized markets.

A Ripple Effect Across the Luxury Landscape in 2025

Aston Martin is far from an isolated case. The 2025 luxury automotive market is a crucible of innovation, sustainability drives, and, increasingly, geopolitical challenges. Major players like Stellantis and Mercedes-Benz have already withdrawn or adjusted their full-year guidance, citing tariff uncertainty as a primary factor. Volkswagen, parent company to several luxury marques like Porsche and Bentley, has consistently warned that the brewing trade conflicts could significantly dent sales figures.

Even before Aston Martin’s announcement, the market showed signs of strain. British counterpart Jaguar Land Rover (JLR), with its distinct lack of significant manufacturing facilities in the US for its high-end models, reportedly paused shipments to the US earlier this year. German luxury giant Audi also allegedly began holding vehicles at US ports, a tactical delay to assess the evolving tariff landscape before committing them to the market at potentially unfavorable prices. These actions are indicative of a widespread industry-wide apprehension, forcing players to hoard, delay, or strategically adjust their US market presence.

Perhaps the most direct precedent for Aston Martin’s potential pricing strategy comes from Ferrari. The Maranello powerhouse, with its similar ultra-luxury positioning and highly price-insensitive clientele, announced last month that it would raise sticker prices by as much as 10%. For a Ferrari 296 GTB or a Roma, that translates to an additional tens of thousands of dollars. While Ferrari’s unparalleled brand loyalty might allow for such aggressive hikes without significant sales erosion, it sets a challenging benchmark. Aston Martin must weigh its own brand equity and customer base against Ferrari’s precedent, seeking a “mixed approach” that balances financial viability with market acceptance.

This scenario prompts a deeper dive into automotive industry economics, especially concerning the elasticity of demand for ultra-luxury goods. Analysts have long posited that high-end customers are generally more willing to absorb price increases. Their purchase decisions often transcend mere utility, delving into factors like status, exclusivity, and passion. However, there’s a ceiling. Even the wealthiest buyers are discerning, and repeated, substantial price hikes could eventually lead to a re-evaluation of perceived value, potentially shifting interest towards competing brands or even alternative high-end vehicle investment opportunities outside the traditional automotive sphere.

The Discerning Consumer: Price Sensitivity and Brand Loyalty in the Ultra-Luxury Segment

The assumption that the ultra-wealthy are entirely price-insensitive is a simplification. While they may not scrutinize every line item on a spec sheet as a mainstream buyer would, their purchasing decisions are often deeply considered, reflecting not just a financial transaction but a lifestyle choice, an investment, or an affirmation of status. A sudden, significant price increase dueven to external factors can alter this delicate equation.

For Aston Martin, known for its blend of traditional British elegance and exhilarating performance, the challenge is maintaining that aspirational allure. Models like the $250,000 Vantage coupe or the formidable $523,000 Vanquish are more than just cars; they are statements. When a 25% tariff adds upwards of $60,000 to the price of a Vantage, or over $130,000 to a Vanquish, it transforms the financial landscape of the purchase. While unlikely to deter every potential buyer, it certainly narrows the accessible market and may prompt some to defer purchases, explore pre-owned markets, or consider other brands that might have a different tariff exposure.

The “mixed approach” being considered by Aston Martin is crucial. It likely involves a strategic blend of measures: perhaps absorbing a portion of the tariff on lower-priced models to keep them competitive, while passing on a larger share on higher-margin, more exclusive models where demand might be less elastic. It could also involve leveraging the bespoke customization programs, where the additional cost of unique specifications might mask the tariff’s impact. The brand’s ability to communicate the continued inherent value, craftsmanship, and exclusivity of its vehicles despite the price adjustment will be paramount in maintaining the strong brand loyalty characteristic of luxury car market trends.

Beyond Price Hikes: Strategic Responses and Long-Term Implications

The tariff situation forces luxury automakers to consider a broader spectrum of strategic responses beyond mere price adjustments.

Supply Chain Re-evaluation: The global nature of automotive manufacturing means components often cross borders multiple times before final assembly. Tariffs on parts, not just finished vehicles, can create cascading costs. Brands are actively looking to optimize their global automotive supply chain, potentially diversifying sourcing to countries without tariff exposure or negotiating more favorable trade terms. This is a monumental task for companies that rely on highly specialized, often hand-crafted, components.

Manufacturing Localization (Limited): For ultra-luxury brands, full-scale US manufacturing is often impractical due to the specialized nature of production, low volume, and the desire to maintain a “Made in” identity. However, some brands might explore limited US assembly for specific models, or establish final assembly points for certain components to bypass some tariffs. This is a complex calculation involving labor costs, infrastructure, and maintaining quality control.

Product Portfolio Adjustments: Brands might prioritize models or variants that have lower tariff exposure or higher inherent margins. For instance, if certain EV components face different tariff rates, it could influence the acceleration of specific future of electric supercars programs. Similarly, increasing focus on markets outside the US could be a viable strategy to offset diminished profitability in America.

Bespoke Experiences and Services: In an era of increasing costs, differentiating through unparalleled customer experience becomes even more critical. Luxury brands might enhance their concierge services, personalized design consultations, or exclusive club memberships, bundling them into the overall value proposition to justify higher price points.

Lobbying and Advocacy: Behind the scenes, the automotive industry, including luxury segments, continues to engage in lobbying efforts to influence trade policy. These efforts, though often slow-moving, are crucial for shaping the long-term regulatory environment.

Looking ahead to the remainder of 2025 and beyond, these tariffs are not merely a temporary blip. They represent a fundamental shift in the US luxury vehicle import tariffs landscape, potentially ushering in an era where the origin of a car’s manufacture plays an increasingly significant role in its market viability and pricing. This could lead to a more diversified global production footprint for some, or a renewed emphasis on brand narratives that celebrate heritage and exclusivity, even at a premium.

The long-term implications could see a reshaping of the competitive order. Brands with some existing US manufacturing capabilities or those with highly flexible global production networks might gain an advantage. Conversely, those tied heavily to single-country production for their premium models face ongoing strategic dilemmas. Moreover, the used luxury car market could see interesting dynamics, with relatively newer, tariff-free models holding their value differently than new imports.

Conclusion: A New Chapter for Automotive Aspiration

Aston Martin’s decision to limit US imports due to tariffs is a stark reminder that even at the pinnacle of automotive luxury, economic realities and political decisions hold sway. The high degree of uncertainty, the delicate dance of pricing scenarios, and the broader industry’s struggle to adapt underscore a pivotal moment for automotive industry economics.

As 2025 unfolds, the luxury automotive sector is not just selling exquisite machines; it’s navigating a complex web of international trade, supply chain vulnerabilities, and evolving consumer expectations. The challenge for brands like Aston Martin is to emerge from this period of disruption not just financially viable, but with their unique allure and aspirational value undiminished. It’s a testament to their resilience and strategic acumen that they are adapting, finding “mixed approaches,” and continuing to craft automotive dreams, even as they sail through choppier economic waters. The future of luxury motoring in the US market will undoubtedly be defined by how deftly these iconic brands can continue to deliver unparalleled experiences while strategically managing the persistent headwinds of import duties.