The High-Stakes Game: Analyzing the Tariff Tangle in the 2025 Luxury Automotive Market

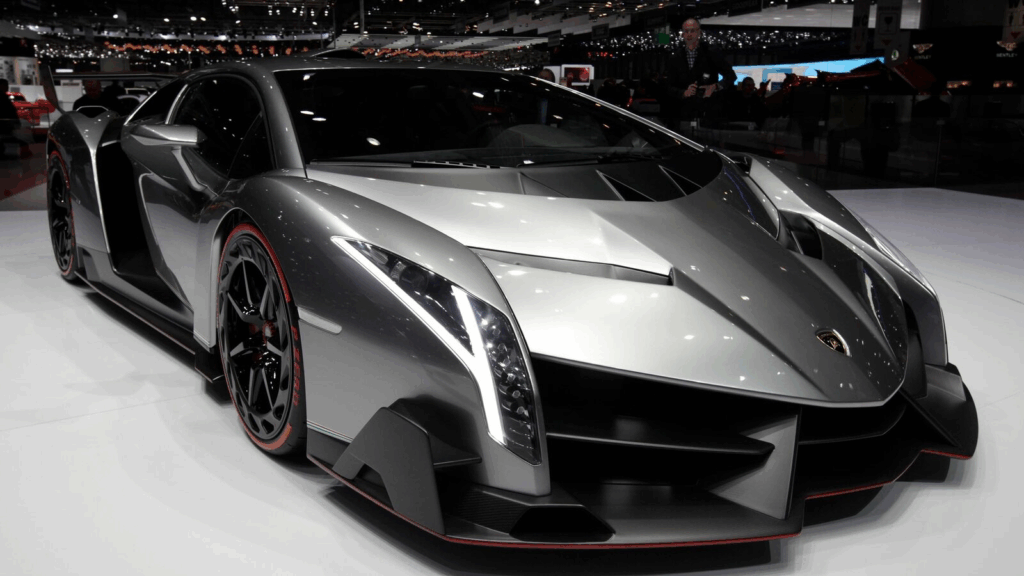

In the rarefied air of the ultra-luxury automotive sector, where six-figure price tags are the norm and exclusivity is a core tenet, even the most prestigious brands find themselves navigating turbulent economic currents. As we move through the second quarter of 2025, the shadow of lingering global trade policies, particularly the “Trump-era” tariffs on imported vehicles and components, continues to reshape the landscape. The recent announcement by Aston Martin, a quintessential British marque synonymous with sophistication and performance, to limit its imports to the United States serves as a stark reminder of the profound and often unpredictable global trade policy impact on the auto industry. This isn’t just about premium marques adjusting inventory; it’s a deep dive into the strategic maneuvers, economic vulnerabilities, and evolving high-end car pricing strategies that define the contemporary supercar market trends.

The decision by Aston Martin to throttle its US bound shipments isn’t made lightly. The American market represents a crucial nexus for luxury vehicle investment, a place where discerning buyers demonstrate an unwavering appetite for bespoke craftsmanship and unparalleled driving experiences. Yet, the imposition of a 25% tariff on imported cars has injected a “high degree of uncertainty” into the meticulous planning of these elite automakers. As CEO Adrian Hallmark articulated in the company’s first-quarter earnings report, Aston Martin is “carefully monitoring the evolving US tariff situation and are currently limiting imports to the US while leveraging the stock held by our US dealers.” This calculated pause underscores the severity of the challenge, as companies weigh the delicate balance between maintaining market presence, preserving profitability, and managing the intricate automotive supply chain disruption that tariffs inevitably cause.

For a brand like Aston Martin, whose vehicles like the $250,000 Vantage coupe or the $523,000 Vanquish are symbols of aspiration, every dollar of added cost has ripple effects. While the initial instinct might be to absorb these additional customs duties luxury imports to protect market share, the sheer scale of the tariff burden makes complete absorption unsustainable. Conversely, passing on the full 25% to consumers could significantly dampen demand, even among a clientele often considered price-insensitive. This leads to what Hallmark describes as a “mixed” approach: neither fully absorbing the impact nor entirely passing it on, but rather strategically adjusting prices where necessary. This nuanced approach highlights the intricate art of high-end car pricing strategies in a volatile market. The wealthy demographic targeted for luxury vehicle investment might be less sensitive to minor price fluctuations, but even they have limits, and competitive pressures remain intense.

This situation isn’t unique to Aston Martin. The entire premium automotive market analysis reveals a sector grappling with similar dilemmas. Just last month, Ferrari, another titan of the exotic car world, announced plans to raise sticker prices by as much as 10%, translating to tens of thousands of dollars on their already exclusive models. This move by Ferrari, often seen as a bellwether for the ultra-luxury segment, signals an industry-wide recognition that the tariff costs are too significant to simply vanish into thin air. Other major players have also felt the squeeze. Stellantis and Mercedes, both significant players in the global automotive arena, recently withdrew their full-year guidance, directly citing tariff uncertainty. Volkswagen, a conglomerate with a vast portfolio including luxury brands like Audi and Porsche, issued warnings that the ongoing trade disputes could materially impact sales figures this year.

The vulnerability of luxury car manufacturers is particularly pronounced because many of them, especially the European and British marques, lack significant manufacturing footprints in the United States. This geographical reality means they cannot easily shift production to circumvent tariffs, unlike some mass-market producers who might have assembly plants across multiple continents. This structural disadvantage forces them to confront the tariffs head-on, either through price adjustments, import limitations, or a combination thereof. British automaker Jaguar Land Rover, for instance, paused shipments to the US earlier this month, while German powerhouse Audi reportedly began holding its cars at US ports, awaiting clarity on customs processing and cost implications. These actions are not just logistical hurdles; they represent a significant drain on cash flow, increase warehousing costs, and complicate inventory management, all contributing to widespread automotive supply chain disruption.

From an analytical perspective, these tariff-induced disruptions expose several critical facets of the luxury automotive ecosystem. Firstly, the elasticity of demand, even within the wealth management luxury goods sector, is not infinite. While buyers of a $250,000 supercar are unlikely to be deterred by a few thousand dollars, a cumulative 10-25% price hike can push certain models out of reach for some, or at least prompt them to reconsider their exotic car purchasing decisions. This is especially true for those buyers who might stretch their budgets or consider entry-level luxury models, where the percentage increase represents a more substantial portion of the overall investment.

Secondly, the tariffs underscore the inherent complexities of global manufacturing and distribution. Modern automobiles, particularly high-performance luxury vehicles, are masterpieces of international engineering and supply chains. Components might originate from dozens of countries, each potentially subject to different customs duties luxury imports. A tariff on the final assembled vehicle might be the most visible impact, but the underlying costs accumulate throughout the production process. This necessitates intricate strategic planning to mitigate financial exposure and maintain production efficiency in the face of escalating protectionist policies. For companies focused on precision and bespoke options, adapting to automotive supply chain disruption without compromising quality is a Herculean task.

Looking ahead, the long-term implications of these tariff policies for the economic outlook automotive sector are profound. Will these temporary adjustments morph into permanent shifts in global production strategies? While establishing a manufacturing plant in the US might be feasible for high-volume producers, it’s a far more challenging proposition for niche luxury brands producing only a few thousand units annually. The cost, time, and logistical complexities often outweigh the benefits of tariff avoidance. This means that for many ultra-luxury marques, the enduring reality might be a continuous balancing act of managing import costs and leveraging brand prestige to justify premium pricing.

Furthermore, these tariffs arrive at a time when the luxury automotive sector is already undergoing a monumental transformation. The imperative to electrify vehicle lineups, invest in autonomous driving technologies, and meet increasingly stringent environmental regulations already demands massive capital expenditure. Adding significant tariff burdens on top of these pre-existing pressures creates a perfect storm, forcing brands to make difficult choices between innovation, market expansion, and maintaining profitability. The conversation around supercar market trends now invariably includes how brands intend to navigate both electrification mandates and trade barriers simultaneously. Will we see a slowdown in the rollout of cutting-edge technologies as resources are diverted to tariff mitigation? Or will brands double down on exclusivity to justify even higher price points?

The strategic responses observed in 2025, from limiting imports to price hikes, reveal an industry in flux. Aston Martin’s “mixed approach” is a blueprint for careful calibration, recognizing that market equilibrium in the luxury vehicle investment segment is a delicate interplay of brand allure, perceived value, and acceptable cost. For affluent consumers engaged in wealth management luxury goods, the decision to purchase an exotic car is often emotional and status-driven, but even these decisions are rooted in an underlying assessment of value.

In conclusion, the ongoing saga of tariffs impacting the luxury automotive market in 2025 is a multifaceted challenge. Aston Martin’s decision to limit US imports is not an isolated incident but a symptom of a broader industrial re-evaluation. The global trade policy impact on the auto industry continues to ripple through supply chains, influence high-end car pricing strategies, and force recalibrations across the premium automotive market analysis. As an expert observer, it’s clear that adaptability, strategic financial planning, and a deep understanding of consumer psychology will be paramount for these iconic brands to not only survive but thrive in this era of elevated customs duties luxury imports. The high-stakes game of luxury car commerce continues, with policymakers and market forces playing an increasingly influential hand in the journey from factory floor to affluent garage.