Navigating the New Reality: Aston Martin and the Enduring Impact of Tariffs on the US Luxury Car Market

In the dynamic and often unpredictable landscape of 2025, the global automotive industry continues to grapple with the multifaceted legacy of past geopolitical trade policies. While headlines often focus on innovation in electric vehicles or autonomous driving, a more fundamental challenge—the persistent shadow of tariffs—continues to shape strategic decisions for even the most exclusive brands. Aston Martin, the quintessential British purveyor of ultra-luxury supercars and SUVs, finds itself at the forefront of this ongoing struggle, openly acknowledging limitations on its imports to the US market. This move isn’t merely a business adjustment; it’s a stark indicator of how automotive trade policy, specifically the tariffs implemented years ago, continues to reverberate, creating a “high degree of uncertainty” that forces even premium manufacturers to recalibrate their luxury vehicle pricing and distribution strategies.

The decision by Aston Martin to curtail its US imports is a significant development, underscoring the enduring economic impact of tariffs on the high-end sector. For consumers in the US luxury car market, this could translate into longer wait times, diminished choice, and ultimately, higher prices for some of the world’s most coveted vehicles. As we delve into the complexities of Aston Martin’s response and the broader implications for the high-end car market trends, it becomes clear that the ripple effects of trade friction are far from settled, challenging established paradigms of international commerce and luxury automotive sales.

The Echo of Past Policy: Section 232 Tariffs and Their Enduring Legacy

To fully comprehend Aston Martin’s current predicament, it’s essential to revisit the genesis of these trade barriers. The tariffs in question primarily stem from the Trump administration’s Section 232 investigations, which, starting in 2018, cited national security concerns to impose duties on imported steel and aluminum, and critically, threatened or implemented tariffs on imported automobiles and automotive parts. While specific rates and applications varied and evolved, the threat and imposition of a 25% tariff on imported cars created immediate and lasting instability.

By 2025, many of these measures, once seen as temporary skirmishes, have morphed into entrenched features of the global automotive supply chain. The initial shockwaves prompted a scramble for automakers worldwide, forcing them to re-evaluate production locations, material sourcing, and logistics. For brands without significant manufacturing footprints within the United States, like Aston Martin, these tariffs directly translate into a substantial increase in the cost of goods sold. This isn’t just about absorbing a 25% surcharge; it’s about the cascading effects on financial planning, investment decisions, and ultimately, the accessibility of their products in a crucial market.

The “high degree of uncertainty” cited by Aston Martin CEO Adrian Hallmark isn’t an exaggeration. It speaks to a perennial challenge in strategic planning: how do you invest billions in product development, manufacturing, and distribution when a significant portion of your revenue stream is subject to unpredictable political headwinds? This uncertainty hampers long-term commitments, discourages expansion, and forces brands to operate with a degree of conservatism that is antithetical to rapid market growth or bold innovation. The enduring nature of these geopolitical trade tensions means that strategies developed years ago are still being refined, adapted, or, in Aston Martin’s case, defensively deployed in the present day.

Aston Martin’s Strategic Maneuver: Limiting Imports and The Delicate Dance of Pricing

Aston Martin’s strategy of “limiting imports to the US while leveraging the stock held by our US dealers” is a calculated move to mitigate the immediate financial strain of these tariffs. In essence, the company is slowing the flow of new vehicles into the country to avoid incurring additional tariff costs on every shipment. Instead, they are prioritizing the sale of existing inventory already within US borders, effectively buying time.

This approach, while pragmatic, carries inherent risks. For dealers, a reliance on finite existing stock means a potential slowdown in new inventory, which can impact sales targets and the freshness of their showroom offerings. For customers, especially those eyeing specific configurations or the very latest models, this could mean extended waiting periods or even disappointment if their desired vehicle isn’t available from the existing pool. This scarcity, while potentially boosting the perceived exclusivity of Aston Martin vehicles, could also frustrate potential buyers and push them towards rival brands.

Hallmark’s acknowledgment of having “pricing scenarios ‘on standby'” reveals the tightrope walk confronting luxury automakers. The company explicitly states it “would not pass on the full impact of the tariffs to customers but would not absorb it entirely either,” describing it as a “mixed” approach. This indicates a sophisticated understanding of their market. On one hand, fully absorbing the 25% tariff would severely erode profit margins, jeopardizing future investment and brand health. On the other, passing on the full amount would make their already high-priced vehicles prohibitively expensive, even for the ultra-wealthy. A $250,000 Vantage, for instance, could see its price jump to over $312,500 with a full pass-through, a significant psychological and financial leap.

The goal is to find an equilibrium point where a portion of the increased cost is absorbed, a portion is passed on, and the brand’s allure remains intact. This delicate balance directly impacts supercar investment value. While scarcity can sometimes increase the perceived value of a collectible, excessive price increases due to external factors like tariffs can dampen buyer enthusiasm, potentially affecting resale markets and the long-term desirability of the brand’s models as wealth management luxury assets. The art of premium automotive brands strategy in such an environment is to manage perceptions and preserve brand equity while navigating unavoidable cost pressures.

The Broader Landscape: How Tariffs Reshape the Luxury Automotive Industry

Aston Martin is not an isolated case; its experience mirrors a wider struggle within the luxury automotive sector. The tariffs have created an environment of protracted uncertainty, compelling numerous major players to reassess their operations.

Consider the recent actions of automotive giants like Stellantis and Mercedes. Both companies, as recently as this past Wednesday (relative to the article’s 2025 timeframe), withdrew their full-year guidance, a stark admission that the predictability required for financial forecasting has been compromised by ongoing tariff volatility. Volkswagen, another titan, has consistently warned that the brewing trade conflicts could significantly dampen sales, affecting profitability across its diverse portfolio of brands, including luxury divisions like Audi and Porsche. These withdrawals of guidance are not mere technicalities; they reflect fundamental disruptions to supply chains, manufacturing schedules, and market demand projections.

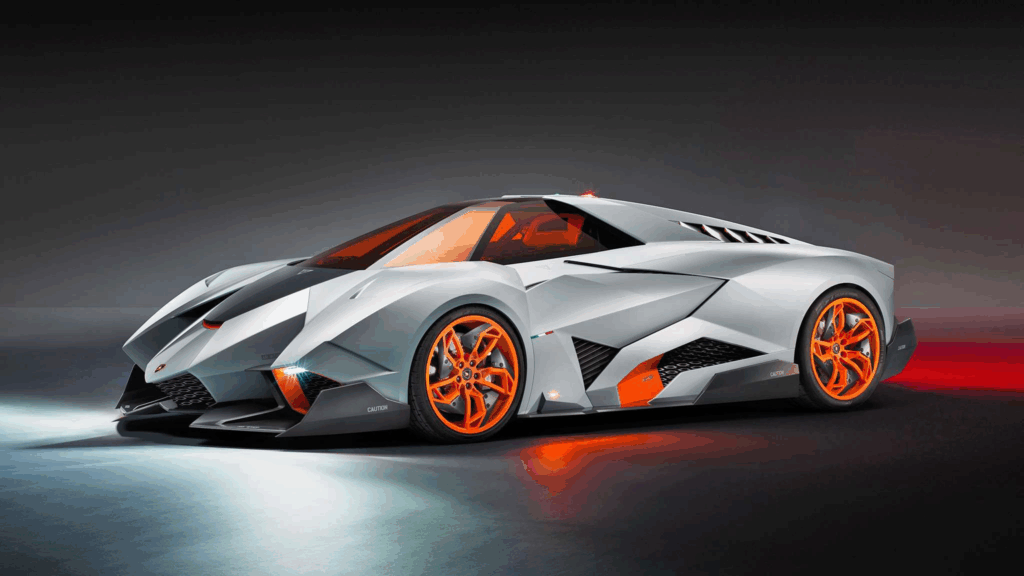

The challenge is particularly acute for luxury car manufacturers. Many of these European and Asian brands have historically relied on exporting their meticulously crafted vehicles from their home countries to lucrative markets like the US. Unlike mass-market brands that have established extensive manufacturing operations within the US (e.g., BMW and Mercedes have large plants in the South), niche luxury players like Aston Martin, Ferrari, or Lamborghini often lack the scale or strategic impetus to replicate complex, low-volume production facilities abroad. Shifting production for a handful of specialized models is not economically viable or logistically straightforward, making them more vulnerable to import duty impact.

The consequences of this vulnerability are tangible. British automaker Jaguar Land Rover (JLR) previously paused shipments to the US, grappling with similar tariff-induced cost increases and supply chain complexities. German marque Audi reportedly began holding cars at US ports, a costly exercise designed to strategically time import clearances and manage tariff liabilities. Such delays and disruptions can lead to significant logistical expenses, storage fees, and, most importantly, frustrated customers and lost sales opportunities. These anecdotes paint a clear picture of an industry constantly adjusting, hoping for stability while preparing for further turbulence.

Ferrari’s aggressive stance, announcing last month that it would raise sticker prices by as much as 10%, adding tens of thousands of dollars to many of its supercars, sets an intriguing precedent. While Ferrari’s unparalleled brand cachet and typically long waiting lists might allow for greater pricing elasticity, it underscores the industry’s shared conclusion: a portion of these tariff costs must be passed on. This collective push towards higher prices due to external pressures marks a significant shift in the luxury vehicle pricing strategies across the entire segment.

The Ultra-Luxury Consumer: Navigating Price Hikes and Exclusivity

The conventional wisdom in the automotive industry is that ultra-luxury customers are “generally more willing to accept price rises.” While there is an element of truth to this—buyers of a $250,000 car are less likely to be deterred by a $5,000 increase than those buying a $25,000 car—this willingness is not infinite. Even the wealthiest consumers operate with a sense of value and expectation.

When price increases are driven by factors beyond enhanced features or technological advancements, such as tariffs, they can be perceived differently. It shifts the value proposition. Customers are not paying more for a better car, but for the same car burdened by external political costs. This subtle distinction can influence purchasing decisions, even among high-net-worth individuals car buying.

Furthermore, the allure of luxury often lies in its exclusivity and seamless acquisition process. Tariffs complicate this. If import limits mean longer waiting lists, less personalized customization options from factory orders, or an overall less streamlined buying experience, it can diminish the “specialness” of the purchase. The psychological aspect of exotic car ownership costs extends beyond the sticker price to the entire journey of acquisition and ownership.

For some, an Aston Martin or Ferrari is more than just transportation; it’s an investment, a status symbol, a piece of art. The supercar investment value can be influenced by market conditions, including supply and demand dynamics skewed by tariffs. While artificial scarcity might initially boost interest, sustained difficulty in acquiring new models or rapidly escalating prices due to duties could ultimately impact the long-term collectibility and financial appeal of these vehicles as wealth management luxury assets. Brands must tread carefully to ensure they do not inadvertently devalue their own products in the eyes of their most discerning clientele.

Navigating the Future: Resilience, Relocation, or Retrenchment?

Looking ahead into the remainder of 2025 and beyond, the luxury automotive industry faces critical questions regarding its long-term strategies in a world defined by persistent trade barriers.

One key avenue for premium automotive brands strategy is diversification of the global automotive supply chain. This could involve sourcing components from countries not subject to the same tariffs, or establishing minor assembly operations closer to key markets, though the latter remains challenging for low-volume manufacturers. However, true resilience against tariffs often requires a complete overhaul of manufacturing locations, a capital-intensive and time-consuming endeavor. While BMW and Mercedes have proven that luxury cars can be successfully built in the US, this is a scale of investment unlikely for an Aston Martin or Ferrari.

Lobbying efforts against tariffs will undoubtedly continue. The automotive industry is a powerful economic force, and concerted pressure from manufacturers, dealers, and consumers could influence future automotive trade policy. However, the political will to remove such measures, once implemented, often faces significant domestic hurdles.

Ultimately, the ongoing import duty impact forces luxury brands to consider difficult choices:

Resilience: Adapt to the new cost structure, refine pricing strategies, and manage customer expectations for availability and delivery.

Relocation: A long-term, expensive, and often impractical solution for many niche brands, involving shifting production facilities closer to markets, which would fundamentally alter their national identity and manufacturing ethos.

Retrenchment: Reduce exposure to highly tariffed markets, focusing instead on regions with more favorable trade agreements. This could mean a smaller presence for some luxury marques in the lucrative US market.

The challenge presented by these tariffs is not merely an inconvenience; it is a fundamental test of adaptability for the entire luxury automotive sector. It forces innovation not just in vehicle design and technology, but in business models, supply chain management, and geopolitical engagement. The question for Aston Martin and its peers isn’t just how they will weather the current storm, but how they will redefine their operations to thrive in a perpetually complex global trade environment.

Conclusion

Aston Martin’s decision to limit US imports in 2025 is a powerful testament to the enduring and disruptive power of tariffs. What began as a series of trade actions years ago has evolved into a persistent challenge, shaping strategic decisions and recalibrating the very fabric of the US luxury car market. The “high degree of uncertainty” continues to be a defining characteristic, impacting everything from luxury vehicle pricing and supercar investment value to the operational flexibility of premium automotive brands strategy.

As Aston Martin navigates this complex terrain with its “mixed” approach to pricing and inventory management, the broader industry watches closely. The experiences of Stellantis, Mercedes, Volkswagen, JLR, and Ferrari all underscore the widespread economic impact of tariffs and the urgent need for robust, adaptable global automotive supply chain solutions. For the discerning consumer eyeing an exclusive Aston Martin, the new reality may mean greater patience and a higher price tag, a direct consequence of a world where automotive trade policy continues to exert a profound influence on even the most coveted symbols of luxury and performance. The road ahead for these iconic brands requires not just engineering prowess, but also unparalleled strategic acumen in a world where geopolitical factors increasingly dictate market access and profitability.